Economic system

Deflationary Economic System

By allowing tokens paid through play to be consumed in the game, it minimizes market distribution, keeping the supply of tokens constant and contributing to value stability.

1) NFT purchase - Decreases circulating supply of FANT

2) Fee from own NFT marketplace - Decreases circulating supply of FANT

3) In-game item purchase(Entrance tickets, Building constructions, Character enhancement fee) - Decreases circulating supply of YAC

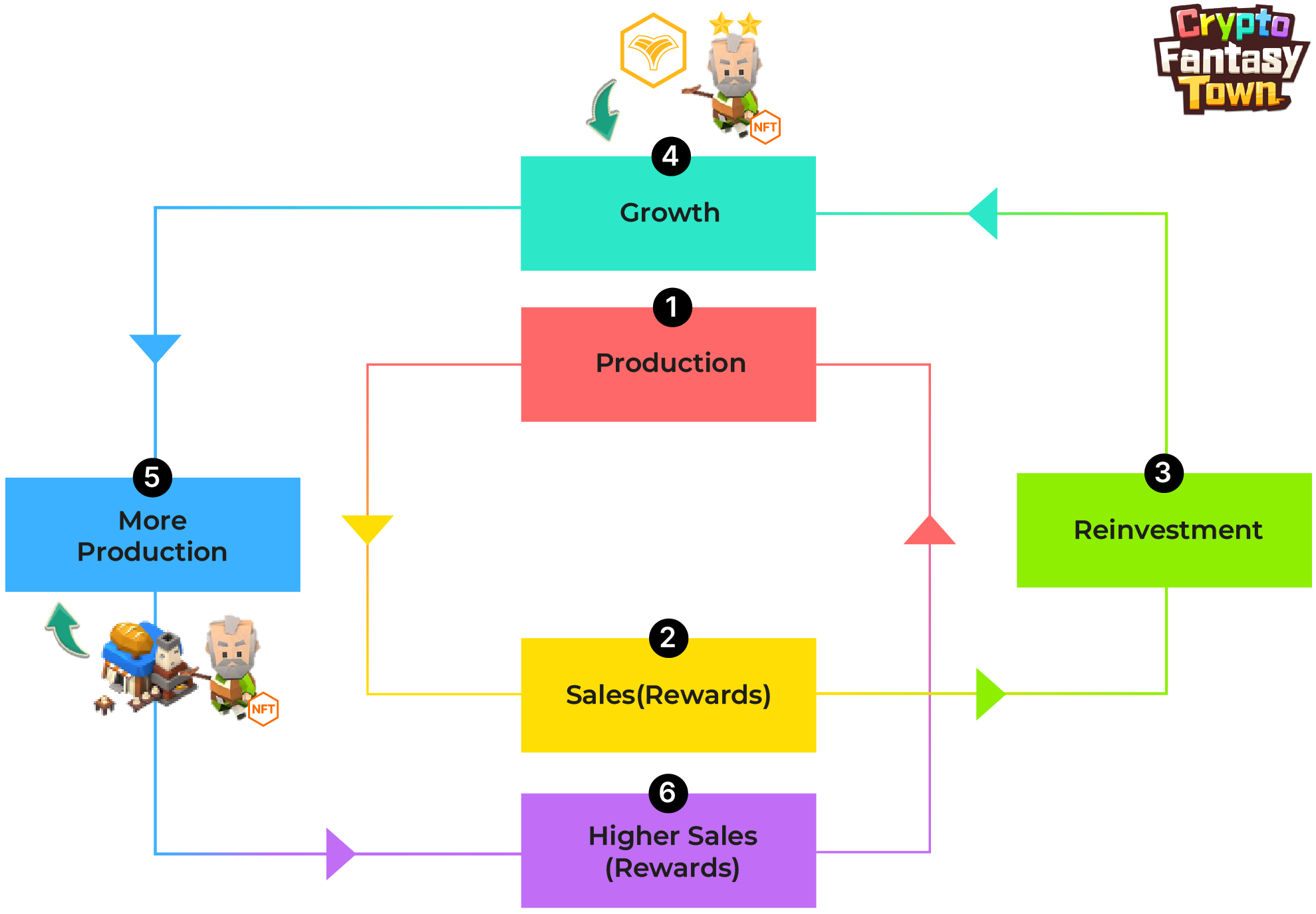

Token Flow

The token flows in a circular structure of production, sales, trade, and reinvestment, and for greater growth, tokens, better NFTs, as well as items acquired through an adventure must be invested.

Production by applying factors such as materials and residents.

Gold and YAC are acquired through the sale of produced items.

Production of goods take place by reinvesting the acquired production items. However, in this case, the acquisition amount does not increase because it does not grow.

For steady growth, YAC, better NFT (character, building, land), and items acquired through adventure are needed.

Produce more efficiently and faster through growth.

Gain more gold and YAC by selling more items through growth.

Staking

LP Token Staking

Users may acquire LP tokens by participating as a liquidity provider of FANT tokens on the Dex exchange. Stake LP tokens at the FANT farm to receive compensation according to relevant wait period. LSR = LS÷LTS×DTI×DR×M LSR : Rewards the user can receive by staking LP token LS : FANT quantity staked by the user before the start of each season LTS : FANT quantity of total amount staked by all users before beginning of each season DTI : Total income of DAO(Fees, Advertising revenue, NFT sales profit, DAO funds profit etc.) DR : Seasonal DTI compensation ratio determined by DAO M : Multiplier according to time

Multiplier(M) : Multiplier increases proportionally with lock-up staking period. If staking takes place without lock-up, the multiplier is 1, with no additional compensation. If users participate in lock-up staking, they will be given an additional benefit of 0.02 per week for the multiplier (M). The multiplier of the product for 25 weeks (approximately 6 months) is 1.5, and the multiplier of the product for 38 weeks (approximately 9 months) is 1.75. Lastly, the multiplier for the product for 50 weeks (approximately 1 year) is 2.

NFT Staking

NFT Staking will continue to provide compensation to character NFT holders, increasing demand and contributing to the preservation and increase of NFT value.

Total Rarity score for Individual(ITR) = sum of (Rarity value * Grade value = Total value)

Example of the Total rarity score calculation:

| Rarity | Grade | Rarity value | Grade value | Total value |

|---|---|---|---|---|

Normal | ★ | 10 | 1 | 10 |

Rare | ★★ | 20 | 2 | 40 |

Legend | ★★★ | 30 | 3 | 90 |

Total rarity score | 140 |

NSR = ITR÷TR×DTI×DR×M NSR : Rewards from NFT staking ITR : Total Rarity Score for Individual TR : Total rarity score before each season DTI : Total income of DAO(Fees, Advertising revenue, NFT sales profit, DAO funds profit etc.) DR : Seasonal DTI rewards prorportion as determined by DAO M : Multiplier over time (same as above)

Relationship between NFT Staking and NFT Lending

Less revenue from lending means more revenue from NFT staking, and less NFT staking means vice versa. Even if compensation through the game is temporarily reduced, NFT demand is preserved because NFT staking can earn compensation outside the game.

Relationship between LP token stocking and NFT stocking

Both staking methods are compensated by FANT, but the amount of compensation obtained by DR (DTI compensation ratio) can vary considerably. While confirming the value of FANT and NFT, DAO can raise the DR of LP token stocking to increase the value of FANT, and when NFT depreciates, it can raise the DR of NFT stocking to induce the value of NFT to increase the value of NFT.

Last updated